Traditional Financial Advisor’s Approach

This will be hidden.

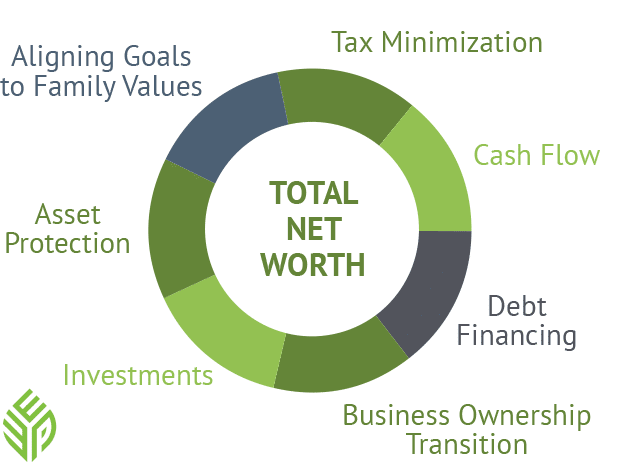

Where the traditional Financial Advisor spends the majority of their time on just your investment assets, we take an entirely holistic approach to your whole financial picture: lifestyle, family needs, business goals, real estate, as well as your traditional investment assets.

As your consultant, we help you with complex issues such as aligning goals to family values, tax minimization, cash flow, debt financing, business ownership transition, investments, and asset protection. We look at all things that affect the goal of growing your total net worth.

This will be hidden.

This will be hidden.

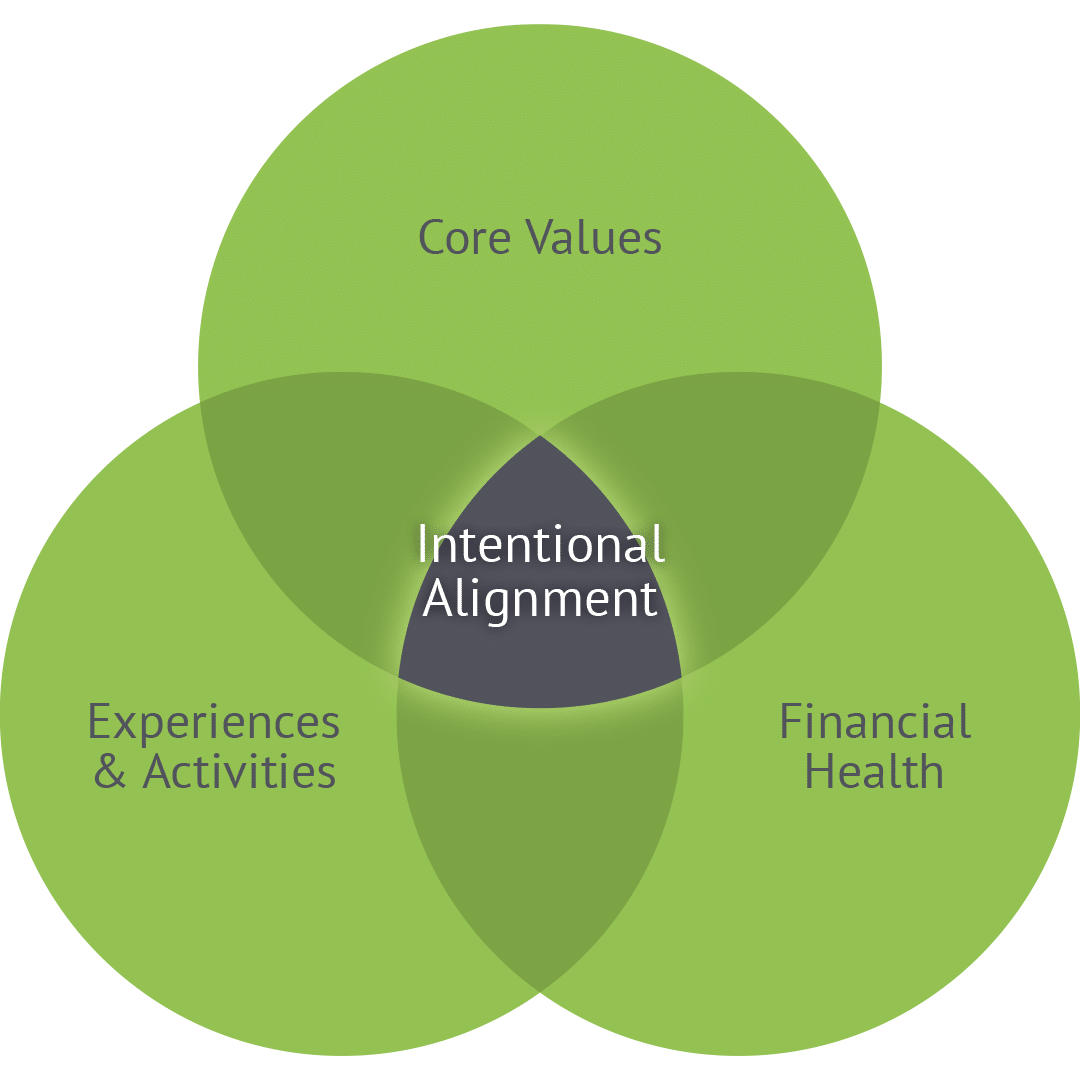

We take a unique approach that we refer to as “intentional alignment.” Intentional alignment allows you to live life deliberately and with purpose. We listen to understand your core values, define what activities/experiences energize you, and guide you towards financial security and financial independence.

When these are aligned, you are maximizing your journey through the E-Wealth Intentional Alignment process.

Your core beliefs that impact your behavior. Helpful when making difficult decisions.

The feeling of having financial security and financial freedom of choice.

Intentional actions you take day-to-day through life’s journey.

You are living your life intentionally. Your actions are aligned with your core values and are financially fit.

Get started with a strategic plan. Stay on course with an ongoing partnership.

This will be hidden.

Possessing an understanding of your business value is perhaps the key ingredient when aiming to undertake a host of strategic activities and decisions. We utilize BizEquity, an innovative technology that allows us to deliver accurate and efficient business valuations, free to clients. When we have a better understanding of what your business may be worth, we can make more informed decisions for your future.